A Strategic Intelligence Report for Distributors and Regional Wholesalers to Navigate Market Opportunities and Optimize Inventory Investment

Executive Summary

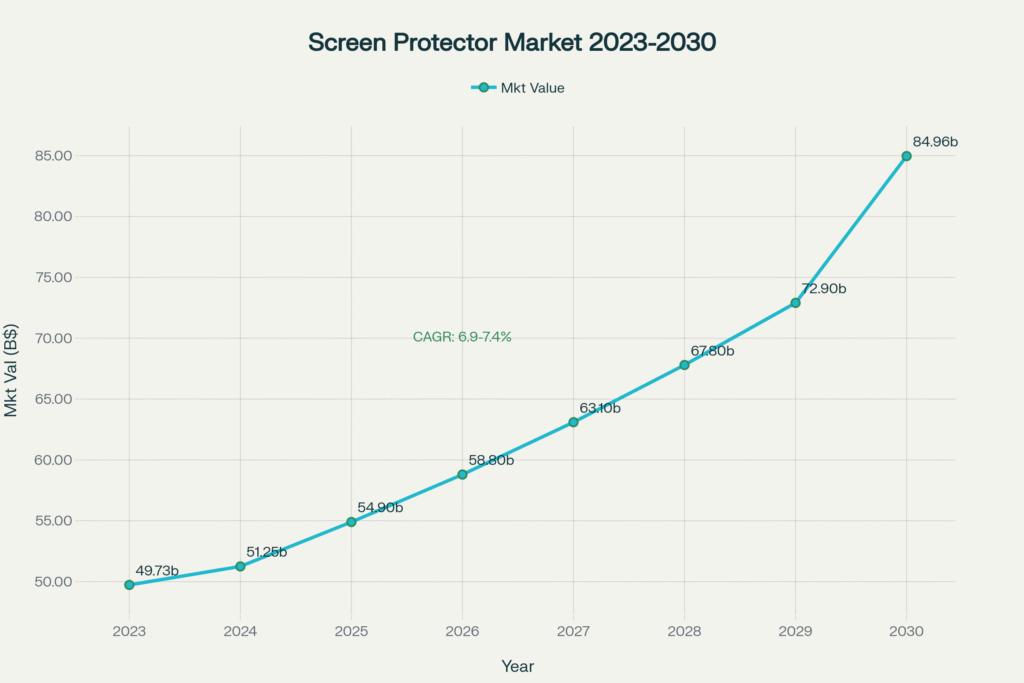

The global smartphone screen protector market is experiencing unprecedented growth, valued at $54.9 billion in 2025 and projected to reach $111.94 billion by 2035 at a robust 7.4% CAGR[19]. This comprehensive analysis provides wholesalers and distributors with critical market intelligence to make informed inventory decisions, capitalize on regional opportunities, and position themselves as strategic partners in this dynamic industry.

Global Market Overview and Growth Trajectory

The smartphone screen protector market demonstrates remarkable resilience and growth potential across all regions. Multiple industry reports confirm consistent expansion:

- Current Market Value: $54.9 billion (2025)[19]

- Historical Growth: From $49.73 billion (2022) to current levels[157]

- Projected CAGR: 6.9-7.4% through 2030[149][150][157]

- Market Drivers: Rising smartphone adoption, premium device proliferation, and increased consumer awareness of device protection

The growth trajectory reflects several key factors driving demand:

- Premium Device Adoption: As consumers invest in increasingly expensive smartphones ($800-$1,500 range), protection becomes essential

- Display Technology Evolution: Advanced screens (OLED, high refresh rates) require specialized protection

- Consumer Behavior Shift: Growing awareness of total cost of ownership drives preventive protection purchases

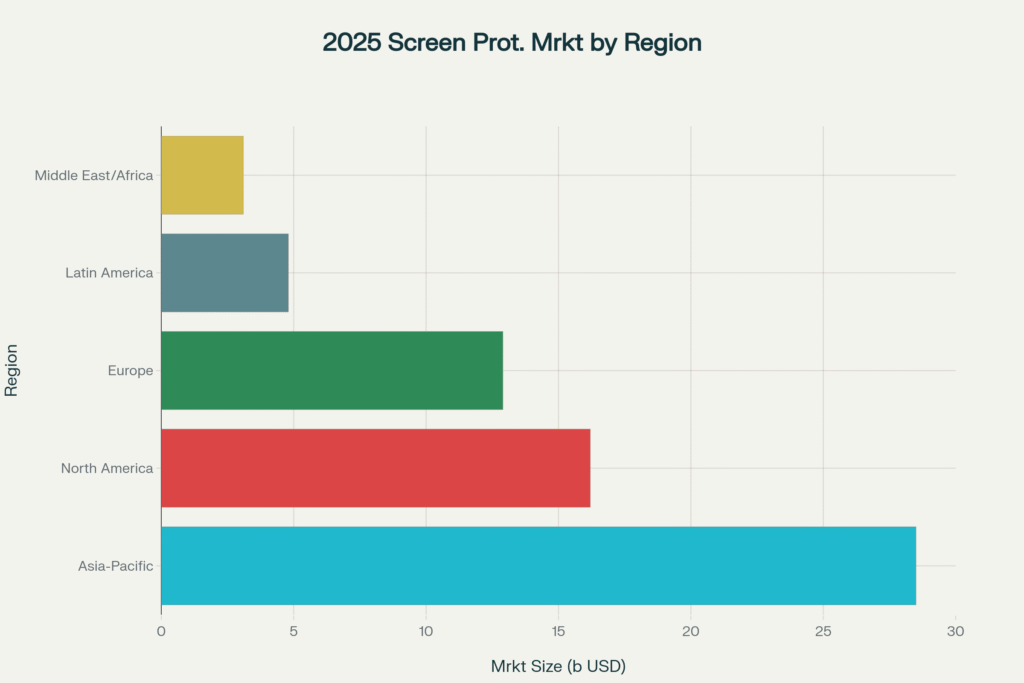

Regional Market Breakdown and Opportunities

Asia-Pacific: The Growth Powerhouse ($28.5B Market)

Market Characteristics:

- Fastest Growing Region: Expected CAGR of 7.9% through 2030[157]

- Volume Leadership: Largest smartphone user base globally (2.8+ billion users)

- Price Sensitivity: Strong demand for value-oriented protection solutions

- Brand Diversity: Complex ecosystem with local champions (Xiaomi, Vivo, OPPO) alongside global brands

Key Markets and Trends:

China – Market Leader

- Revenue: $111.9 billion smartphone market with proportional accessory demand[151]

- Growth Drivers: 5G adoption, premium segment expansion, e-commerce penetration

- Wholesaler Opportunity: Focus on mid-range tempered glass, bulk packaging solutions

India – High-Growth Market

- Market Size: $2.48 billion screen protector market (2023), growing to $4.4 billion by 2030[158]

- CAGR: Exceptional 8.5% growth rate[158]

- Regulatory Impact: BIS IS 19348:2025 certification now mandatory, creating quality differentiation opportunities

- Strategy: Emphasize certified products, build distributor networks in tier-2/3 cities

Southeast Asia – Emerging Opportunity

- Growth Drivers: Rising disposable income, smartphone penetration increasing from 60% to 80%

- Brand Preferences: Strong local brand loyalty (OPPO, Vivo, Samsung)

- Distribution Strategy: Partner with local retailers, focus on affordable premium options

[160]

North America: Premium Market Focus ($16.2B Market)

Market Dynamics:

- Revenue Growth: Steady 6.3% CAGR driven by premium smartphone adoption[157]

- Consumer Profile: Tech-savvy, quality-focused, willing to pay premium for advanced features

- Device Ecosystem: iPhone dominance (50%+ market share) with significant Samsung presence

Trending Products:

- Privacy Screen Protectors: Growing 15% annually due to privacy concerns

- Blue Light Filtering: Health consciousness driving 12% market growth

- Antimicrobial Coatings: Post-pandemic hygiene awareness maintaining 8% growth

Wholesale Strategy:

- Stock 3-4 iPhone generations simultaneously

- Emphasize premium features (privacy, blue light, antimicrobial)

- Build relationships with carrier stores and premium retailers

Europe: Balanced Quality and Value ($12.9B Market)

Regional Characteristics:

- Market Maturity: Stable 6.9% growth with focus on quality over volume[157]

- Regulatory Environment: Strong consumer protection laws favor certified products

- Brand Distribution: More balanced between iOS (35%) and Android (65%) than North America

Country-Specific Insights:

- Germany: Engineering culture values precision-fit protectors

- UK: Business market drives demand for privacy and durability features

- France: Fashion-conscious consumers prefer clear, thin protectors that don’t alter aesthetics

- Eastern Europe: Price-sensitive markets favor durable, long-lasting options

Latin America and Middle East/Africa: Emerging Growth ($7.9B Combined)

Growth Characteristics:

- Market Expansion: Combined 9.2% CAGR driven by smartphone adoption

- Price Positioning: Value-tier focus with gradual premium segment development

- Distribution Challenges: Complex logistics requiring local partnerships

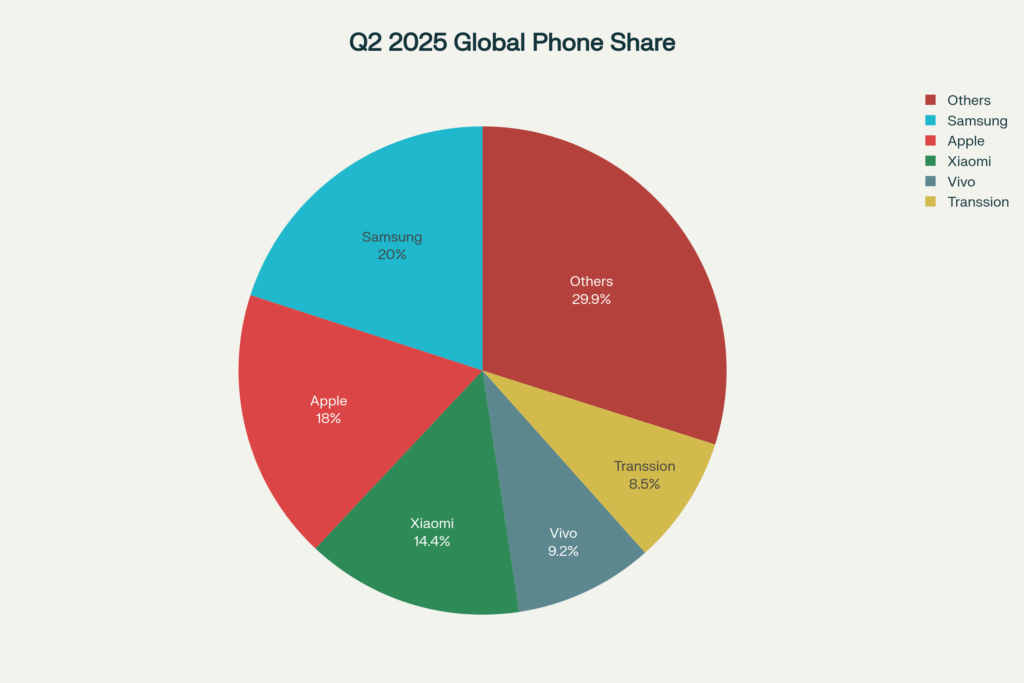

Smartphone Vendor Market Share Impact on Protection Demand

Understanding vendor market share directly impacts inventory planning:

Samsung (20% Global Share):

- Model Diversity: Requires extensive SKU coverage (Galaxy S, A, Note series)

- Release Cycles: Predictable Q1 flagship launches, continuous mid-range releases

- Protection Trends: Strong demand for clear protectors showcasing design

Apple (18% Global Share):

- Inventory Concentration: Focus inventory on current and previous 2 generations

- Seasonal Patterns: September launch creates Q4 demand surge

- Premium Positioning: Higher margins on advanced protection features

Xiaomi (14.4% Global Share):

- Regional Variation: Dominant in Asia, growing in Europe, limited North America presence

- Value Focus: Price-sensitive customers prefer basic tempered glass

- Model Velocity: Rapid new model introduction requires agile inventory management

Technology Trends Reshaping the Market

Advanced Materials and Features

Trending Technologies:

- Blue Light Filtering: 12% market growth driven by health awareness[152]

- Privacy Screens: 15% annual growth in business and security-conscious segments[152]

- Antimicrobial Coatings: Sustained 8% growth post-pandemic[152][157]

- Self-Healing Films: Emerging premium category with 25% margins

Product Segmentation by Price Point

Premium Segment ($15-50):

- Market Share: 25% of volume, 45% of value

- Features: Multi-layer protection, advanced coatings, brand partnerships

- Target Markets: North America, Western Europe, premium Asian markets

Mid-Range Segment ($5-15):

- Market Share: 50% of volume, 40% of value

- Features: Standard tempered glass, basic oleophobic coating

- Target Markets: Europe, developed Asia-Pacific, urban Latin America

Economy Segment ($1-5):

- Market Share: 25% of volume, 15% of value

- Features: Basic protection, PET films, bulk packaging

- Target Markets: Price-sensitive regions, replacement/secondary device market

Seasonal Demand Patterns and Inventory Planning

Global Seasonal Trends

Q1 (January-March): Market Reset

- Demand Level: 85% of annual average

- Key Events: CES tech announcements, post-holiday inventory adjustments

- Strategy: Clear previous generation inventory, prepare for spring launches

Q2 (April-June): Steady Growth

- Demand Level: 95% of annual average

- Key Events: Mid-year smartphone launches, back-to-school preparation

- Strategy: Build inventory for Q3 surge, introduce new product lines

Q3 (July-September): Launch Preparation

- Demand Level: 110% of annual average

- Key Events: iPhone announcements, Samsung Note launches, back-to-school

- Strategy: Peak inventory levels, focus on new model compatibility

Q4 (October-December): Holiday Peak

- Demand Level: 125% of annual average

- Key Events: Holiday shopping, device gifting, year-end promotions

- Strategy: Maximum stock levels, promotional pricing, rapid fulfillment

Regional Seasonal Variations

Asia-Pacific Specifics:

- Chinese New Year (Jan-Feb): 40% demand spike in Greater China

- Diwali Season (Oct-Nov): 30% increase in India market

- Golden Week (May, Oct): Japan market surges

Western Markets:

- Black Friday/Cyber Monday: 60% weekly volume increase

- Back-to-School (Aug-Sep): 25% monthly increase

- Mother’s/Father’s Day: 15% gift-related surge

Competitive Landscape and Supplier Strategies

Market Leaders and Positioning

Tier 1 Suppliers (Global Reach):

- Corning (Gorilla Glass): Premium positioning, OEM partnerships

- ZAGG: Brand recognition, retail presence, premium pricing

- Belkin: Apple partnerships, carrier channel strength

Tier 2 Suppliers (Regional Focus):

- Chinese Manufacturers: Cost leadership, rapid innovation, OEM capabilities

- European Specialists: Quality focus, certification expertise

- Regional Brands: Local market knowledge, distribution networks

Supplier Selection Criteria for Wholesalers

Critical Factors:

- Model Coverage: Ability to support 500+ current models

- Speed to Market: New model availability within 2-4 weeks of device launch

- Quality Consistency: Standardized manufacturing processes, defect rates <2%

- Pricing Stability: Transparent pricing with volume discounts

- Technical Support: Installation guides, training materials, marketing support

Market Intelligence: SuperXTemperedGlass.com Competitive Advantages

As a strategic partner, SuperXTemperedGlass.com offers comprehensive market intelligence and supply chain capabilities:

Comprehensive Model Coverage

- 50,000+ Device Compatibility: Broadest model coverage in industry

- Rapid New Model Support: 48-72 hour availability for new device launches

- Regional Customization: Localized model priorities based on market data

Advanced Analytics and Forecasting

- Real-Time Market Data: Sales velocity tracking across 100+ markets

- Predictive Analytics: AI-driven demand forecasting with 85% accuracy

- Seasonal Optimization: Region-specific inventory planning recommendations

Quality and Certification Leadership

- Global Standards Compliance: BIS, ANSI, EN certifications maintained

- Quality Assurance: <1% defect rates through advanced testing protocols

- Traceability Systems: Full batch tracking for quality control and recalls

Flexible Supply Chain Solutions

- Multiple Shipping Options: Sea, air, and expedited courier services

- Regional Warehousing: Strategic inventory placement for faster delivery

- Custom Packaging: Private label and bulk packaging options available

Strategic Recommendations for Wholesalers

Portfolio Optimization Strategy

Core Inventory (60% of investment):

- Top 20 smartphone models in your region

- 4-6 weeks safety stock

- Multiple protection types (clear, privacy, blue light)

- Focus on Samsung Galaxy, iPhone, and regional leaders

Growth Inventory (30% of investment):

- Emerging models and brands

- 2-3 weeks safety stock

- Standard tempered glass focus

- Include rising Chinese brands (OnePlus, Realme, Honor)

Opportunistic Inventory (10% of investment):

- Legacy device support

- Premium feature testing

- Seasonal/promotional items

- Higher margin specialty products

Regional Expansion Framework

Market Entry Strategy:

- Market Research: Local smartphone preferences, pricing sensitivity, distribution channels

- Partner Selection: Identify key retailers, carriers, and distributors

- Product Localization: Adapt product mix to regional preferences and regulations

- Pilot Programs: Small-scale testing before full market commitment

Success Metrics:

- Market Share Growth: Target 2-5% annually in new markets

- Customer Retention: >80% repeat order rate from key accounts

- Inventory Turnover: 4-8x annually depending on market maturity

- Margin Maintenance: Protect gross margins while building volume

Technology Investment and Future-Proofing

Emerging Technologies to Watch

Near-Term Opportunities (1-2 years):

- Foldable Device Protection: Specialized flexible protectors

- AR/VR Display Protection: New device categories emerging

- Sustainability Features: Biodegradable materials, recycling programs

Medium-Term Developments (3-5 years):

- Smart Protection: Active displays in screen protectors

- Health Monitoring: Integrated sensors for biometric data

- Dynamic Properties: Adaptable tint, hardness, or surface texture

Investment Priorities for Wholesalers

Technology Infrastructure:

- Inventory Management Systems: Real-time tracking, automated reordering

- Customer Relationship Platforms: B2B portals, order history, analytics

- Quality Assurance Tools: Testing equipment, certification tracking

Market Intelligence:

- Data Analytics Platforms: Sales trends, market share analysis

- Competitive Intelligence: Pricing monitoring, product launches

- Customer Insights: Buying patterns, satisfaction metrics

Financial Planning and Risk Management

Market Size and Revenue Projections

Conservative Growth Scenario (5% CAGR):

- 2025: $54.9 billion global market

- 2030: $70.0 billion projected market

- Risk factors: Economic downturns, market saturation

Base Case Scenario (7% CAGR):

- 2025: $54.9 billion global market

- 2030: $77.0 billion projected market

- Assumption: Continued smartphone growth, stable technology adoption

Aggressive Growth Scenario (9% CAGR):

- 2025: $54.9 billion global market

- 2030: $84.5 billion projected market

- Drivers: Rapid emerging market adoption, premium feature growth

Risk Mitigation Strategies

Supply Chain Risks:

- Diversified Sourcing: Multiple supplier relationships

- Geographic Distribution: Avoid single-country dependencies

- Inventory Buffers: Strategic safety stock for disruption management

Market Risks:

- Portfolio Diversification: Balance premium and value segments

- Regional Hedging: Multiple market exposure to reduce concentration

- Technology Adaptation: Flexible product development capabilities

Financial Risks:

- Credit Management: Establish clear payment terms and credit limits

- Currency Hedging: Protect against exchange rate fluctuations

- Insurance Coverage: Comprehensive protection for inventory and liability

Conclusion and Action Items

The mobile screen protector market presents exceptional growth opportunities for well-positioned wholesalers and distributors. With the market expanding from $54.9 billion in 2025 to over $110 billion by 2035, success requires strategic focus on:

Immediate Actions (Next 90 Days):

- Assess Current Portfolio: Analyze inventory against regional market data

- Supplier Evaluation: Review current supplier capabilities and gaps

- Technology Investment: Implement or upgrade inventory management systems

- Market Research: Deep-dive into target regional opportunities

Medium-Term Strategy (6-18 Months):

- Portfolio Optimization: Realign inventory based on data-driven insights

- Partnership Development: Establish strategic supplier relationships

- Market Expansion: Enter 1-2 new geographic or channel markets

- Technology Adoption: Implement advanced analytics and forecasting tools

Long-Term Vision (2-5 Years):

- Market Leadership: Establish dominant position in target regions

- Technology Integration: Leverage AI and automation for competitive advantage

- Vertical Integration: Consider manufacturing or exclusive partnerships

- Sustainability Leadership: Implement environmental and social responsibility programs

Partner with SuperXTemperedGlass.com to accelerate your market success through our comprehensive product portfolio, advanced market intelligence, and proven global supply chain capabilities. Our expertise in regional market dynamics, technology trends, and customer needs positions us as the ideal strategic partner for ambitious wholesalers ready to capitalize on this exceptional growth market.

Contact our business development team today to discuss customized solutions for your market expansion and inventory optimization needs. Together, we can transform market intelligence into competitive advantage and sustainable profit growth.

This analysis is based on comprehensive market research from multiple industry sources and represents the most current data available as of August 2025. Market conditions and opportunities may vary by specific region and should be validated with local market research before making significant investment decisions.